29 Jan 2021

A global pandemic, economic uncertainty and further lockdowns – 2020 had it all. But how exactly have business energy consumption and wholesale prices been affected?

With more uncertainty ahead, it’s vital that businesses understand not just what they pay for their energy, but the wider issues at play. New market developments and price volatility will all impact businesses in different ways. By looking closely at what’s happened so far, we can shed some light on what to expect from 2021 and beyond – and ultimately – how to plan for it.

In this article we dig deeper into business energy costs, what goes into your prices, and what the considerations are for businesses thinking ahead.

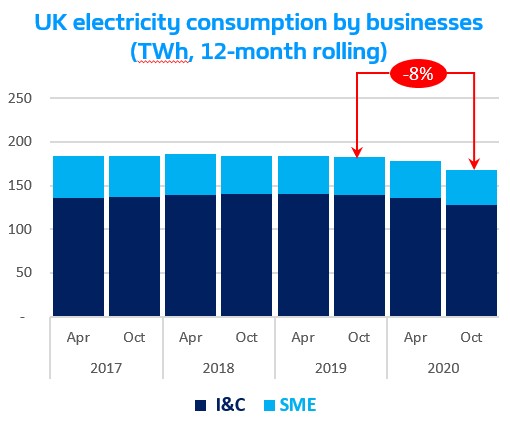

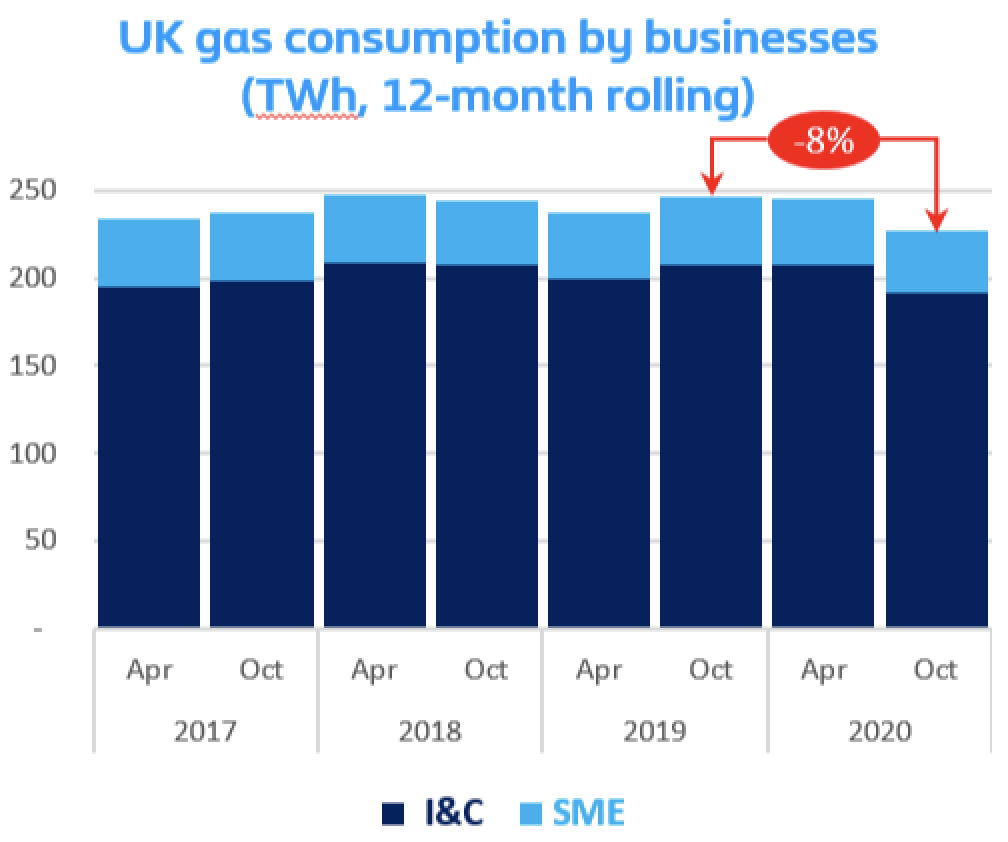

With almost every industry affected by the global pandemic, it’s not so surprising that energy consumption by business customers declined in 2020 compared to 2019. The impact of lockdown restrictions were clearly felt in Q2 2020 when it appears that electricity demand declined by 30% and 15% respectively when businesses were forced to close[1].

What is interesting about last year’s business energy consumption is how quickly things appeared to return to normal. As more businesses opened up post-lockdown, energy consumption bounced back strongly with daily demand for electricity and gas gradually returning to previous years’ levels. In the end, the decline in overall energy consumption – around 8% year-on-year – was less severe than many had anticipated as businesses adapted to the restrictions. It suggests once lockdown restrictions are lifted fully, it won’t be long before consumption gets back to what it was before the pandemic.

Figure 1: Cornwall Insight business energy market report October 2020

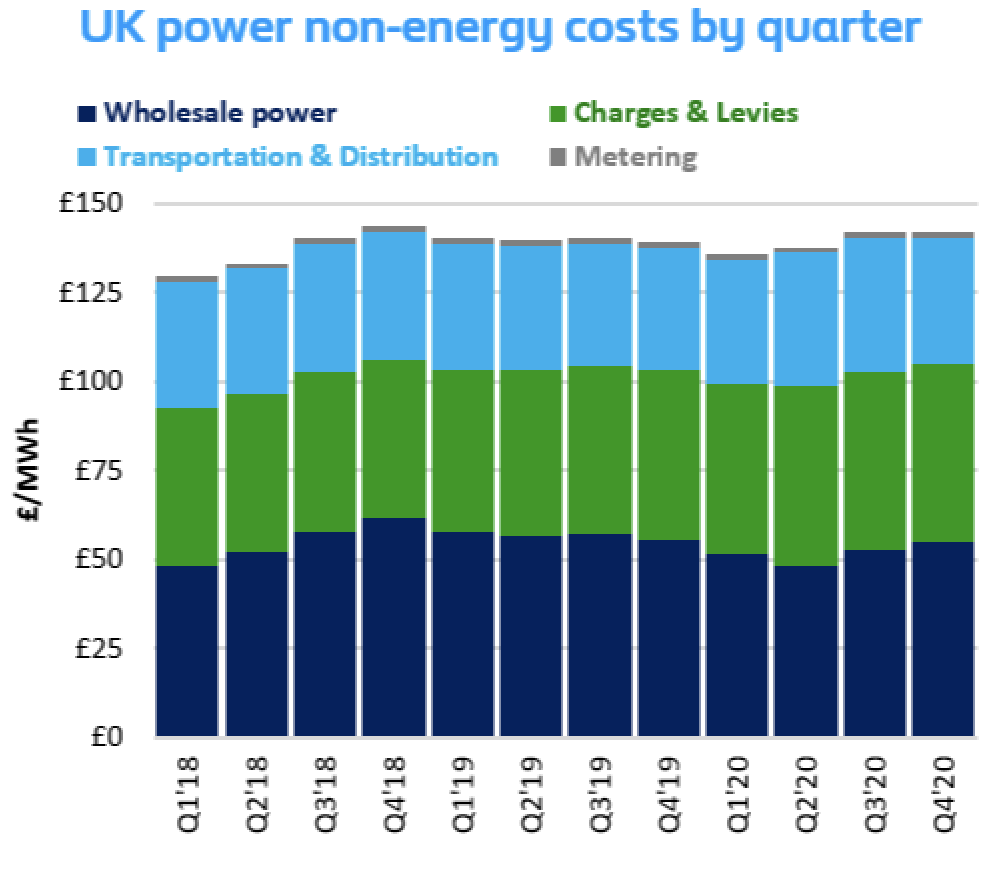

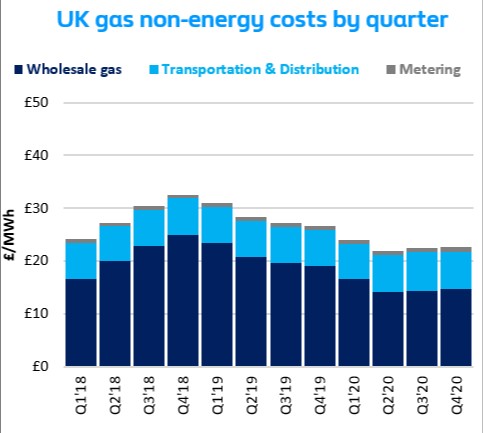

What businesses pay for their energy is made up of two things – commodity, which is the wholesale market and prices, and non-commodity, which relates to any system and policy charges. Most customers on a fixed tariff would not be impacted by movements in wholesale prices or non-commodity costs. However, some may have pass-through clauses which allow suppliers to increase both the unit rate and the standing charge if costs go up. Businesses are always advised to confirm the tariff’s terms and conditions with their supplier or energy broker.

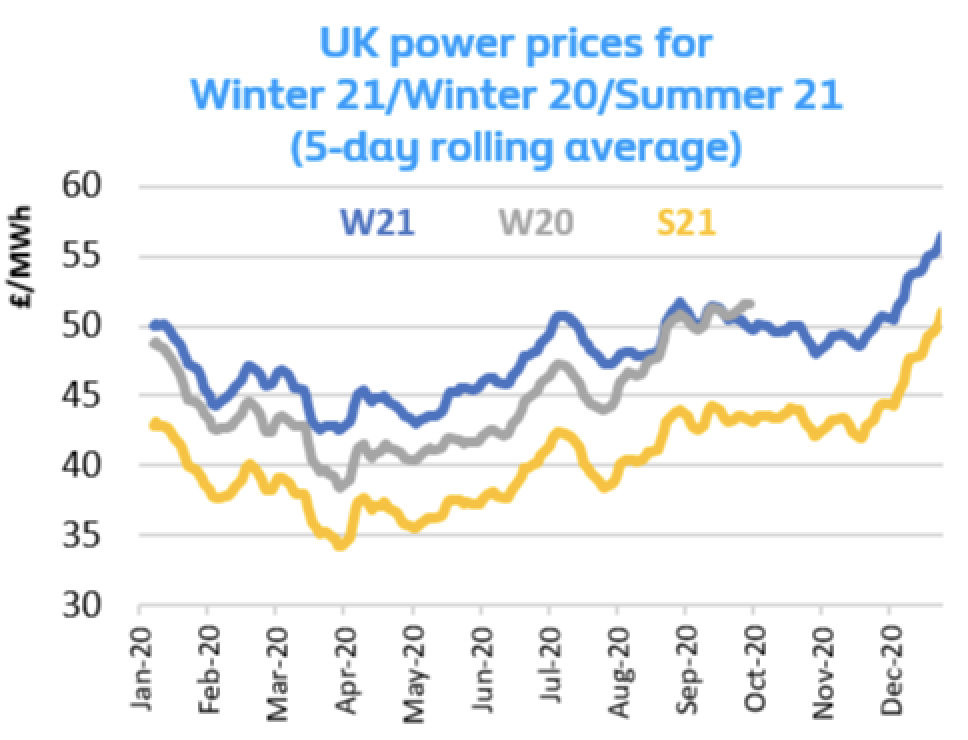

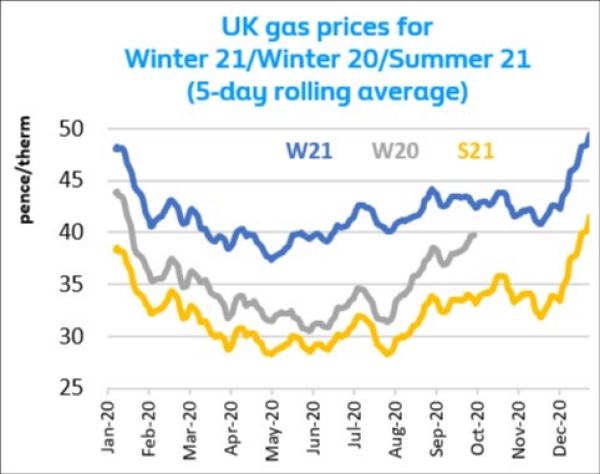

On the whole, UK gas and electricity prices have continued to increase, albeit at a slower pace during the last quarter of 2020 than the previous two quarters. However, the cost of purchasing energy in the wholesale market increased faster than any other single cost. In fact, wholesale costs have continued to rise since the spring.

Wholesale prices bounced back strongly through to the end of 2020 in response to: a recovery in energy demand; the impact of unusual weather (low temperatures and low wind generation), which forced the power system operator to encourage traditional generators to produce more electricity to balance the system; a global race for securing gas supplies (LNG for instance), particularly from Asian buyers.

UK power and gas prices for Summer 21 increased by 22% and 12% respectively in 2020

Figure 2: UK power prices for Winter 20/Summer 21: ICE UK Power Settlement Prices

At first glance it looks like third party costs remained broadly flat quarter-on-quarter. However, a closer look reveals significant variation across the following:

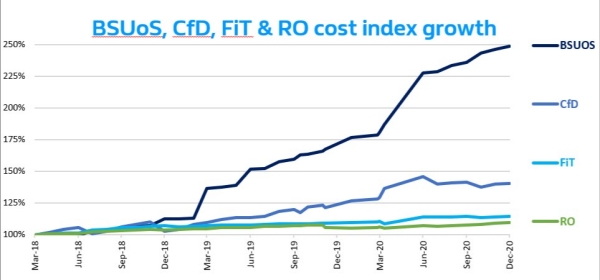

Energy generators and suppliers are liable for BSUoS charges, which are levied by the National grid in order to recover the cost of day-to-day operation of the transmission system.

The CfD scheme supports the generation of large scale, low carbon electricity such as offshore wind farms.

The FiT is a charge on suppliers to support small scale renewable generators (<5MW capacity).

The reason this is significant is that most non-energy costs are fixed at the start of the year, some are even set more than a year in advance. The non-energy costs listed above are the exception.

Figure 3: Non-energy costs including Policy and BSUoS cost index growth for a sample business customer with a non-half hourly meter: Charges & Levies include RO, CCL, CfDs, CM. Transmission/Distribution components include TNUoS, BSUoS, DUoS

The fall in power demand as a result of the COVID-19 lockdowns and other factors led to a sharp rise and volatility of BUSoS charges. Despite efforts to stabilise things, the National Grid ESO issued a record number of alerts for tight margins in November and December. Suppliers are responding to this by placing higher risk premium on their BSUoS pricing, which will be felt by businesses throughout 2021.

The CfD scheme is administered by The Low Carbon Contracts Company (LCCC). They pay the difference between the strike price and wholesale market price as a subsidy to generators. However, the fall in electricity demand and low wholesale prices following the first lockdown meant available revenue to make these payments fell. To cover the shortfall and to keep the scheme going, the government loaned the LCCC £75.1m. Although this will be repaid in Q2 2021, there is an LCCC interim levy forecast at £9.733/MWh for Q4 2020 – that’s an increase of 14% from Q3 2020.

Under the FiT scheme, participants are guaranteed subsidies for 20 years. And despite the pandemic, subsidies paid to generators will continue. In fact, many expect subsidies to increase slightly to account for an overall decline in volume demand.

There is one more non-energy cost that’s expected to increase: The Renewables Obligation (RO). As part of RO, energy suppliers must source a percentage of their electricity from renewable sources. Suppliers recoup this charge from consumers.

Over the past three years a number of energy suppliers have failed to meet their commitments and have gone out of business. As a result, RO payments have been mutualised. Given the current challenging economic climate and the impact of further lockdowns on businesses and energy demand, additional supplier exits, and the resulting RO mutualisation is a definite possibility.

Figure 4: Cost index growth of BSU0S, CfD, FiT & RO

The full effects are yet to be seen. However, those businesses hardest hit by the pandemic have already been forced into major restructuring processes or store closures. Others, including some high-profile retail names such as Debenhams, Arcadia Group and Peacocks have even gone into administration.

Demand for energy by businesses is generally linked to economic activity and as the UK economy enters into another national lockdown, this is likely to continue to put extra downward pressure on energy consumption for the remainder of the first quarter.

The knock-on effect for UK businesses with fluctuations in supply and demand is price volatility. However, assuming consumption and customer energy usage patterns recover to normal levels once lockdown restrictions are lifted, the market will stabilise, energy contracts will be priced more accurately, and businesses will have more supply options available to them, like longer term deals and non-standing charge tariffs.

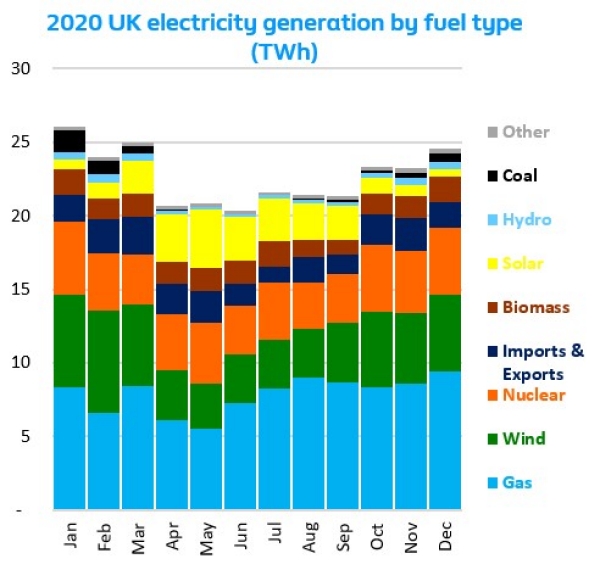

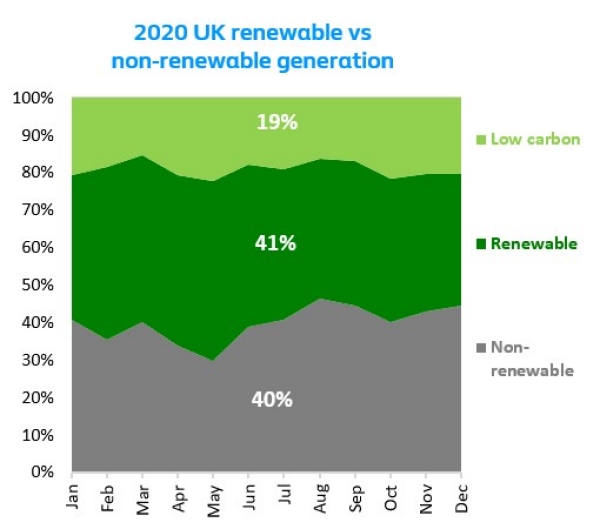

Despite all the uncertainty, one thing is clear – 2020 appears to have been the greenest year on record for the UK electricity system. A sure sign that renewable electricity is gradually becoming a major source of energy in the UK. And that wasn’t the only potential record broken.

According to the National Grid, the UK recorded its longest period without coal power since the Industrial Revolution (1,630 hours, nearly 68 days) and the first ever coal-free Christmas day. However, considering the UK still gets about 40% of its power from gas, there’s still a way to go.

It’s likely that the UK will depend on both renewable and non-renewable energy including nuclear for some time. However, this may give everyone time to prepare for the challenges ahead.

For example, as renewables become more mainstream the energy system is likely to become less stable. Businesses and energy suppliers alike will need a more flexible and price sensitive approach to balance out the increased volatility of demand and supply.

Figure 5: National Grid ESO Monthly Insights, Elexon and Sheffield Solar

Faced with ongoing market uncertainty and a challenging economic climate, businesses may want to rethink their energy strategy while they batten down the hatches. Understanding your consumption and energy prices as a priority, will help you find ways to lower both.

Green investment is accelerating in 2021 and is high on the UK Government agenda with the launch of the Energy White Paper, designed to clean up the energy system and reach net zero emissions by 2050.

Quick wins and low hanging fruit like smart metering and switching to a green business energy tariff, along with some energy efficiency measures, may provide practical changes in the short term.

But the race to net zero is on, and it’s only a matter of time before you’ll need to focus your business energy strategy on decarbonisation and embedding sustainability at the heart of your organisation.

Source

Centrica news: Resilient financial performance in the second half of 2020

Related posts

British Gas business Quarterly Report

19th May 2022

In "Energy News"

8th November 2022

In "Energy News"

20th September 2022

In "Energy Efficiency"

The views, opinions and positions expressed within the British Gas Business Blog are those of the author alone and do not represent those of British Gas. The accuracy, completeness and validity of any statements made within this blog are not guaranteed. British Gas accepts no liability for any errors, omissions or representations. The copyright in the content within the British Gas Business Blog belongs to the authors of such content and any liability with regards to infringement of intellectual property rights remains with them. See the Fuel mix used to generate our electricity. Read about making a complaint about your business energy.