Read about the Government’s continuing support to business energy bills.

1st April 2023 – 31st March 2024

This scheme replaces the Energy Bill Relief Scheme (EBRS) which ended on 31st March 2023. The scheme aims to provide support to customers most impacted by higher energy costs.

The wholesale price is currently lower than the Government price threshold, meaning most customers won’t see a discount under the new scheme. However, if the wholesale price increases above the Government price threshold, a discount will be applied to eligible customers bills.

You can find the wholesale price on the day you agreed your contract by visiting the Government website

The scheme will be available to non-domestic energy customers that are:

You can view your contract by logging into your online account. Be wary of scammers during this period. If you get a message asking for your bank details, this could be fraudulent. You should report messages you think are suspicious.

As part of the scheme Energy and Trade Intensive Industries and Heat Networks can apply to receive a higher level of support.

Eligible businesses will have 90 days from the date they become eligible to apply. For most customers this is 90 days from the portal opening. However, some customers who become eligible later will still be able to apply.

To apply you'll need to provide:

Through the Government website. If you need help with your application, contact the Government support team on:

Telephone: 030 0400 5251

Email: support@ebds.beis.gov.uk

Website: https://www.gov.uk/guidance/energy-bills-discount-scheme

We won’t be able to apply the higher level of support to your bills until your eligibility has been confirmed by the Department for Energy Security and Net Zero (DESNZ).

If your application is successful, the discount will be backdated to the date of eligibility the Government confirms.

For more information about the schemes see the FAQs below.

A: The scheme is due for approval in parliament by the end of April. Suppliers won’t be able to apply the discount until the scheme is approved. Don’t worry, the discount will apply to bills from 1st April 2023, we'll apply the discount to eligible bills automatically once the scheme is finalised.

A: Support under the new government schemes has significantly reduced. This means businesses who previously received an Energy Bill Relief Scheme discount, could be ineligible or receive a lower discount under the new Energy Bills Discount Scheme. This is because:

However, if your business is an Energy & Trade Intensive Industries or Heat Network then you may be eligible for additional support.

A: The wholesale cost is the price that we buy the energy at. We then add other costs such as network charges and operating fees to create your unit price. This applies to all energy suppliers.

A: Any discounts that you may be entitled to will be shown individually on your gas and electricity bills.

A: The scheme is universal across all energy suppliers across both gas and electricity. No matter which energy supplier you're with, if you're eligible, the support you'll receive will be the same.

A: Energy brokers sometimes called Third-Party Intermediaries (TPIs) can't influence the per unit cost reductions that will be applied to your bills under this scheme. If you're eligible, you don't need to take out a new contract or change your contract for the discount to be applied to your bills.

A: The scheme will apply to eligible non-domestic energy customers from 1st April 2023 until 31st March 2024.

A: You don't need to contact us to apply for the Energy Bills Discount Scheme. If you're eligible, we will apply the discount automatically.

However, if you're an Energy and Trade Intensive Industry or Heat Network you will be need to apply for a higher level of support.

A: The Government has recently announced businesses using a licence-exempt supplier, also known as non-standard customers, can now apply for help with their bills from April 2023 to March 2024.

Eligible customers will need to apply through the Non-Standard Cases form. These customers can also apply for support under both the Energy Bills Discount Scheme and the backdated support from the Energy Bill Relief Scheme.

Payments will be made either to the provider to pass on or directly to the customer depending on who made the application. For more information on this scheme and to check business eligibility, please visit the Government Website.

A: If you are eligible for the new Government Support Scheme (EBDS) we’ll need to reissue your eligible invoices to apply the discount.

A: Firstly, you’ll need to check if your wholesale price qualifies you for a discount. You can check this on the Government Website.

If your wholesale price does qualify you for a discount, you’ll be able to see the amount applicable for your fuel type on this page too.

A: Apply now through the Government website

A: This scheme works in the same way as the Energy Bills Discount Scheme.

If your application is successful, we'll apply the additional support to 70% of your energy use subject to a maximum discount. The Energy Bills Discount Scheme will then be applied to the remaining 30% of your energy use, if your wholesale price is above the Government price threshold.

See the wholesale price on the date you agreed your contract

Apply now through the Government website

A: You'll be eligible for the higher level support if:

A: If your business operates in one of these sectors you could be eligible for support as an Energy and Trade Intensive Industry

A: The Government will determine eligibility based on the details provided in your application. In some instances, further validation of eligibility may be required, meaning that you may be asked for additional information. The government will use a range of data sources, including Companies House data and eligibility for other support schemes to make the initial determination.

A: The wholesale cost is the price that we buy the energy at. We then add other costs such as network charges and operating fees to create your unit price. This applies to all energy suppliers.

A: Any discounts that you may be entitled to will be shown individually on your gas and electricity bills.

A: The scheme is universal across all energy suppliers across both gas and electricity. No matter which energy supplier you're with, if you're eligible, the support you receive will be the same.

A: We understand that rising energy costs are concerning. Visit our financial difficulty guide where we provide advice and options on ways to reduce your business energy bills over the coming years.

A: If you're an intermediary (a British Gas customer, who in turn bills another organisation that uses your energy supply), please share the above information with your end consumers.

If your end consumer is approved for a higher level of support, you'll need to:

Step 1:Contact the Government on 030 0400 5251 to provide information about your British Gas account

Step 2:Once you've done this, please visit britishgas.co.uk/business/certificate to tell us the percentage of energy used by your end consumer. We'll use this to apply the correct amount of discount to your bill.

You must pass on all the discount you receive under this scheme to eligible customers. You also have an obligation to write to your end user within 30 days of receiving the discount, to explain how you'll pass this on.

A: Firstly, you’ll need to check if your wholesale price qualifies you for a discount. You can check this on the Government Website.

If your wholesale price does qualify you for a discount, you’ll be able to see the amount applicable for your fuel type on this page too.

If you’ve been approved for the Energy and Trade Intensive Industries discount, we’ll apply this to 70% of your consumption. We’ll then apply the EBDS discount rate to the remaining 30% of your consumption.

A: Apply now through the Government website

A: Heat networks supply heating and hot water to domestic end users. Therefore, support under this scheme aims to protect domestic end users who have not been supported by the Energy Price Guarantee (EPG). This means Heat Networks are required by law to pass on the discount to their domestic end users.

A: If your unit rate is above the Minimum Supply Price, you'll receive a discount. We'll apply the full published discount, provided it doesn’t take your unit rate below the Minimum Supply Price. If it does, your discount will be capped so that your unit rate doesn’t go below the Minimum Supply Price. In some cases, after applying the full published discount your unit rate will still be above the Minimum Supply Price.

See the wholesale price on the date you agreed your contract

Apply now through the Government website

A: You'll be eligible for support as a Heat Network if you:

A: The Government will determine eligibility based on the details provided in your application. In some instances, further validation of eligibility may be required, meaning that you may be asked for additional information. The government will use a range of data sources, including Companies House data and eligibility for other support schemes to make the initial determination.

A: Any discounts that you may be entitled to will be shown individually on your gas and electricity bills.

A: The scheme is universal across all energy suppliers across both gas and electricity. No matter which energy supplier you're with, if you're eligible, the support you'll receive will be the same.

A: We understand that rising energy costs are concerning. Visit our financial difficulty guide where we provide advice and options on ways to reduce your business energy bills over the coming years.

A: If you're an intermediary (a British Gas customer, who in turn bills another organisation that uses your energy supply), please share the above information with your end consumers.

If your end consumer is approved for a higher level of support, you'll need to:

Step 1:Contact the Government on 030 0400 5251 to provide information about your British Gas account

Step 2:Once you've done this, please visit britishgas.co.uk/business/certificate to tell us the percentage of energy used by your end consumer. We'll use this to apply the correct amount of discount to your bill.

You must pass on all the discount you receive under this scheme to eligible customers. You also have an obligation to write to your end user within 30 days of receiving the discount, to explain how you'll pass this on.

A: Firstly, you’ll need to check if your wholesale price qualifies you for a discount. You can check this on the Government Website.

If your wholesale price does qualify you for a discount, you’ll be able to see the amount applicable for your fuel type on this page too.

If you’ve been approved for both the Energy and Trade Intensive Industry discounts and the Heat networks discount, we’ll apply the Heat Networks discount to 100% of your consumption.

11th November 2022 – 31st March 2023

The Qualifying Financially Disadvantaged Customer discount aims to support some customers who are not protected by a Fixed Price Plan or Fixed Term Flex Contract.

We will apply the discount by reducing the unit rate of eligible contracts between 11th November 2022 and 31st March 2023. This discount is in addition to the Energy Bill Relief Scheme discount, which will be listed on your bill separately. This means your Energy Bill Relief Scheme discount amount may reduce because it is being applied to your lowered unit rate but the overall discount you'll receive will not reduce.

The Government criteria for receiving the discount is that you are not supplied under a Fixed Term Contract and that you’ve paid all your bills within the last 28 days.

If you agree a new Fixed Price Plan or Fixed Term Flex Contract, you will not be eligible for the Qualifying Financially Disadvantaged Customer discount.

A: The Qualifying Financially Disadvantaged Customer discount will

apply from 11th November 2022 until 31st March

2023 and will be applied to eligible consumption used in this

period. The scheme may continue, change, or stop, based on a Government review due early in 2023.

A: You'll start to see reduced unit rates in the bills we send in December. This will include charges for your energy use for the discount period starting on 11th November 2022.

A: Your price will remain the same both during and after the scheme. During the scheme we will apply the discount by reducing your unit rate. If your prices change or you start a new plan before the scheme closes, we will recalculate your discount and charge you a different reduced unit rate, if you are still eligible.

A: No, QFDC is designed to provide support to help with the cost of energy arising from the increases in wholesale energy costs– these costs are not part of the standing charge.

A: If both your gas and electricity contracts are eligible, we will reduce both sets of unit rates for all eligible energy use.

A: The scheme is universal across all energy suppliers across both gas and electricity. No matter which energy supplier you're with, the support you'll receive will be the same if you're eligible. However, if you agree a new Fixed Price Plan or Fixed Term Flex Contract, you won’t be eligible for the QFDC discount.

A: The Government criteria for receiving the discount is that you are not supplied under a Fixed Term Contract. Any new Fixed Price Plans or Fixed Term Flex Contracts agreed with British Gas business will not be eligible for QFDC discount.

A: The discount is automatic. This means if you are eligible for the QFDC discount you don't need to contact us or apply to the scheme to access the support.Be wary of scammers during this period. If you get a message asking for your bank details, this could be fraudulent. You should report messages you think are suspicious.

A: The QFDC discount will apply to eligible energy use between 11th November 2022 and 31st March 2023. The Government has said that they will review the scheme in early 2023. They have said there may be an option to extend the scheme for longer for business sectors that are considered vulnerable. We don't know what business sectors this may apply to.

A: We understand that rising energy costs are concerning. Visit our financial difficulty guide where we provide advice and options on ways to reduce your business energy bills over the coming years.

A one off payment due by 10th March 2023

This is a one off payment of £150 to non-domestic customers who aren't on the gas grid and use an alternative fuel for heating purposes.

You don't need to apply for this payment. The Government have identified eligible customers and we'll automatically apply this to eligible accounts.

This payment will be added to electricity accounts that were on supply with us on 8th January 2023. If you have multiple sites with us that are eligible, you’ll receive one payment per unique address.

If we're unable to apply the payment to your bill, we'll write to you separately to let you know how we will be sending the payment. If you receive your bills quarterly you may see this payment reflected after 10th March.

You must have:

A: You'll still be eligible for the payment if you were the account holder on 8th January 2023. We'll reissue your final bill with the £150 payment. If this puts your account into a credit, we'll automatically refund you.

A: You'll still be eligible for the payment if you were the account holder on 8th January 2023. We'll reissue your final bill with the £150 payment. If this puts your account into a credit, we"ll automatically refund you.

A: We'll apply the payment to your energy account and show this on your bill. If we're unable to add this to your account, we'll write to you to let you know how we’ll provide your payment.

A: If you have multiple sites that are off grid, you'll receive £150 for each unique address.

1st October 2022 – 31st March 2023

Under this scheme, the Government is providing a discount on wholesale gas and electricity prices for all eligible non-domestic customers. To calculate your discount, the wholesale portion of the unit price during this period will be compared to a baseline 'Government supported price'.

The scheme will be available to non-domestic energy customers that are:

In addition to this scheme, we've also set up a £15m support fund to help small businesses manage their energy costs. Find out more on our business energy support fund page

A: Fixed contract - Where the Fixed Price Contract has an agreement date on or after 1st December 2021 customers will be eligible for a discount. This is based on the amount by which the Reference Wholesale Price for the agreement date exceeds the Government supported price. In some cases the Government supported price exceeds the Reference Wholesale Price, so no discount will be applicable. The table of discounts can be found on the Government Energy Bill Relief Scheme.

The Government supported price is

21.1p/kWh for electricity and 7.5p/kWh for gas. Your final

retail unit price less your discount cannot go below the

Government supported price.

Flexible contract – A volume Weighted Average Price (WAP) will be calculated for each month based on all transactions made in that period. The WAP will not include any fees that are not directly related to the cost of wholesale energy. The discount is calculated as the difference between the WAP and the Government supported price, subject to the maximum discount of 34.5p/kWh for electricity and 9.1p/kWh for gas.

The Government supported price is 21.1p/kWh for electricity and

7.5p/kWh for gas. Your final retail unit price less your

discount cannot go below the Government supported price.

Out of contract/Deemed - You will be eligible for a discount if your retail unit price is above the Government supported price. The discount is initially set at 34.5p/kWh for electricity and 9.1p/kWh gas.

The Government supported price is 21.1p/kWh for electricity and 7.5p/kWh for gas. Your final retail unit price less your discount cannot go below the Government supported price.

Customers on out of contract or Deemed rates may also be eligible for further support through the Qualifying Financially Disadvantaged Customers scheme.

A: If your current contract is not eligible for a discount, but it is due to end before the scheme ends on 31st March 2023, your next contract could be eligible for the scheme.

A: The Energy Bill Relief Scheme will apply from 1st October 2022 until 31st March 2023 and will be applied to consumption used in this period.

A: Energy brokers sometimes called Third-Party Intermediaries (TPIs) can't influence the per unit cost reductions that will be applied to your bills under this scheme. If you're eligible, you don't need to take out a new contract or change your contract for the discount to be applied to your bills.

A: The Government will provide a discount on your gas and electricity unit prices. To calculate your discount, the wholesale portion of the unit price you would be paying this winter will be compared to a baseline Government supported price which is lower than currently expected wholesale prices this winter.

Provided it doesn't take your unit price below 21.1p for kWh and 7.5p for kWh for gas, the Government supported price for all non-domestic energy users in Great Britain has been set at:

Any discounts such as Direct Debit will be taken prior to the Government discount. Unlike the discount received by domestic customers, this will only apply to the wholesale portion of your unit price.

A: We held off sending bills whilst we worked with the Government to

apply the Energy Bill Relief Scheme discount to eligible customers.

Now that we have all the details, we've started sending bills

including the discount. If you haven't received a bill yet we'll

send one soon.

The Government recently announced further support for some

businesses if they are a Qualifying Financially Disadvantaged

Customer. If you're eligible for this discount there may be a

further delay whilst we apply this. For more information scroll to

our Qualifying Financially Disadvantaged Customer section.

If you have recently renewed your contract, there may be a short

delay in issuing your first bill whilst we update the applicable

discounts under the Energy Bill Relief Scheme.

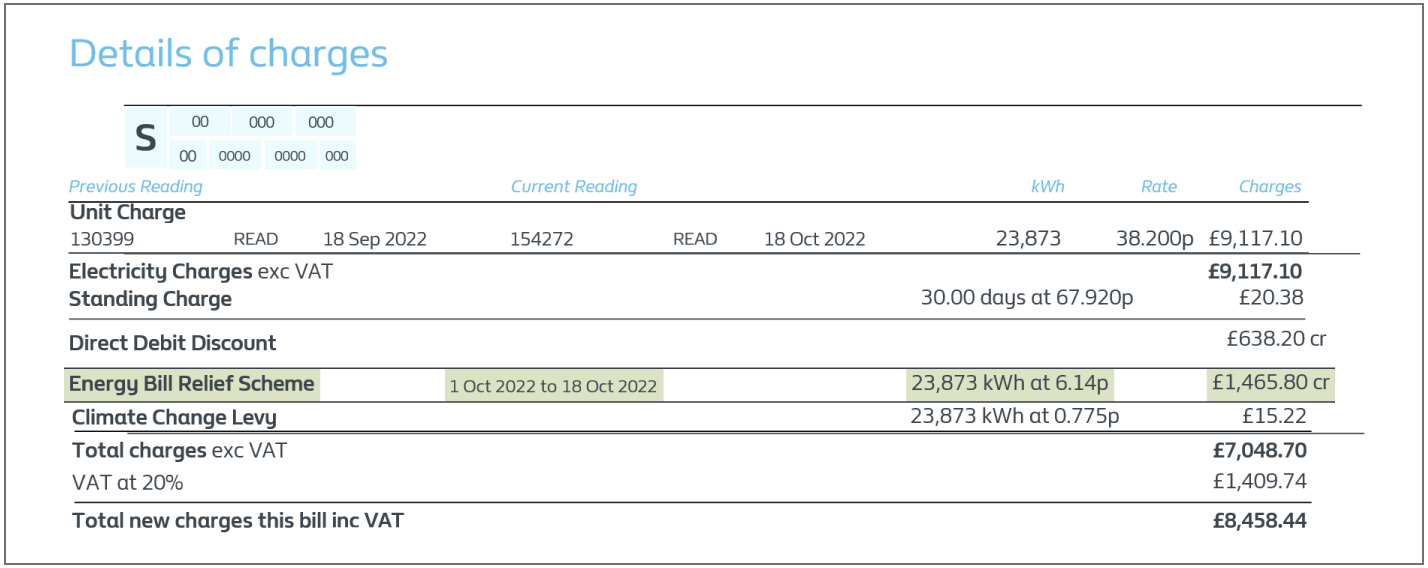

A: The discount will be displayed as an additional line on your bill, within the 'Details of Charges' section - labelled Energy Bill Relief Scheme. The new line will show the p/kWh discount rate, the consumption quantity it applies to and the cash amount of the discount for the invoiced period.

A: Your agreed sale price will remain the same both during and after the scheme but the discount as part of the scheme will be deducted from your bill. If your price changes or you start a new plan before the scheme closes, your discount will be recalculated and applied to your new price automatically.

A: No, only the unit rate. Parts such as Standing Charge, Capacity Charges, CCL, VAT are excluded from the scheme.

A: No, EBRS is designed to provide support to help with the cost of energy arising from the increases in wholesale energy costs– these costs are not part of the standing charge.

A: Standing charges are a combination of metering costs and fixed

network costs. They are a reflection of a customer's usage and the

cost of delivering energy through the network. Ofgem have introduced

a new charging methodology recently (Targeted Charging Review

)

that has changed how these costs are reflected in a standing

charge.

A: Any discounts that you may be entitled to will be shown individually on your gas and electricity bills.

A: The scheme is universal across all energy suppliers across both gas and electricity. No matter which energy supplier you're with, the support you'll receive will be the same if you're eligible, based on your product and agreement date.

A: If you move suppliers, and you're eligible to receive discounts, then you will still receive any discount as all suppliers work to the regulations. The same discount rate (p/kWh) would be applied based on the government scheme and on your product and agreement date.

A: No, any discounts will be shown on eligible invoices post the start of the contract and for the duration of the Energy Bill Relief Scheme.

A: If you agree to a new fixed price contract after 1st October 2022, you will receive support on the same basis - if your new contract starts before 31st March 2023. This applies if you're joining us as a new customer or renewing your energy contract. If you have recently renewed your contract, we will update the applicable discount to reflect the new agreement date. This may result in a short delay in issuing your first invoice.

A: The discount is automatic. This means if you are eligible for the Energy Bill Relief Scheme you don't need to contact us or apply to the scheme to access the support. You can read the full Government guidance .

Be wary of scammers during this period. If you get a message asking for your bank details, this could be fraudulent. You should report messages you think are suspicious.

A: The Energy Bill Support Scheme will apply to the energy non-domestic customers use from 1st October 2022 and ends on 31st March 2023.

A: We understand that rising energy costs are concerning. Visit our financial difficulty guide where we provide advice and options on ways to reduce your business energy bills over the coming years.

Whether you're eligible or not, we're here to support in any way we can. Here are some of the ways we can help:

Page Last Updated on 7th August 2023, 10:00am GMT